How to Navigate Bank Accounts in Australia's Creative Scene

Choosing the Right Bank Account

As a creative soul navigating Melbourne's buzzing art community, finding the right bank accounts open can be as invigorating as a display at the Fitzroy design hubs. For young creatives like us, mastering the basics of bank accounts isn't just necessary; it can be the key to ensuring financial stability along with artistic success. The trick is to choose accounts that align with your freelance lifestyle while supporting your savings goals.

First, consider what type of account best suits your needs. A joint savings account could be ideal if you're planning a shared future with your partner. Shared financial planning doesn't just foster teamwork; it creates a practical space to harmonize personal and joint expenses.

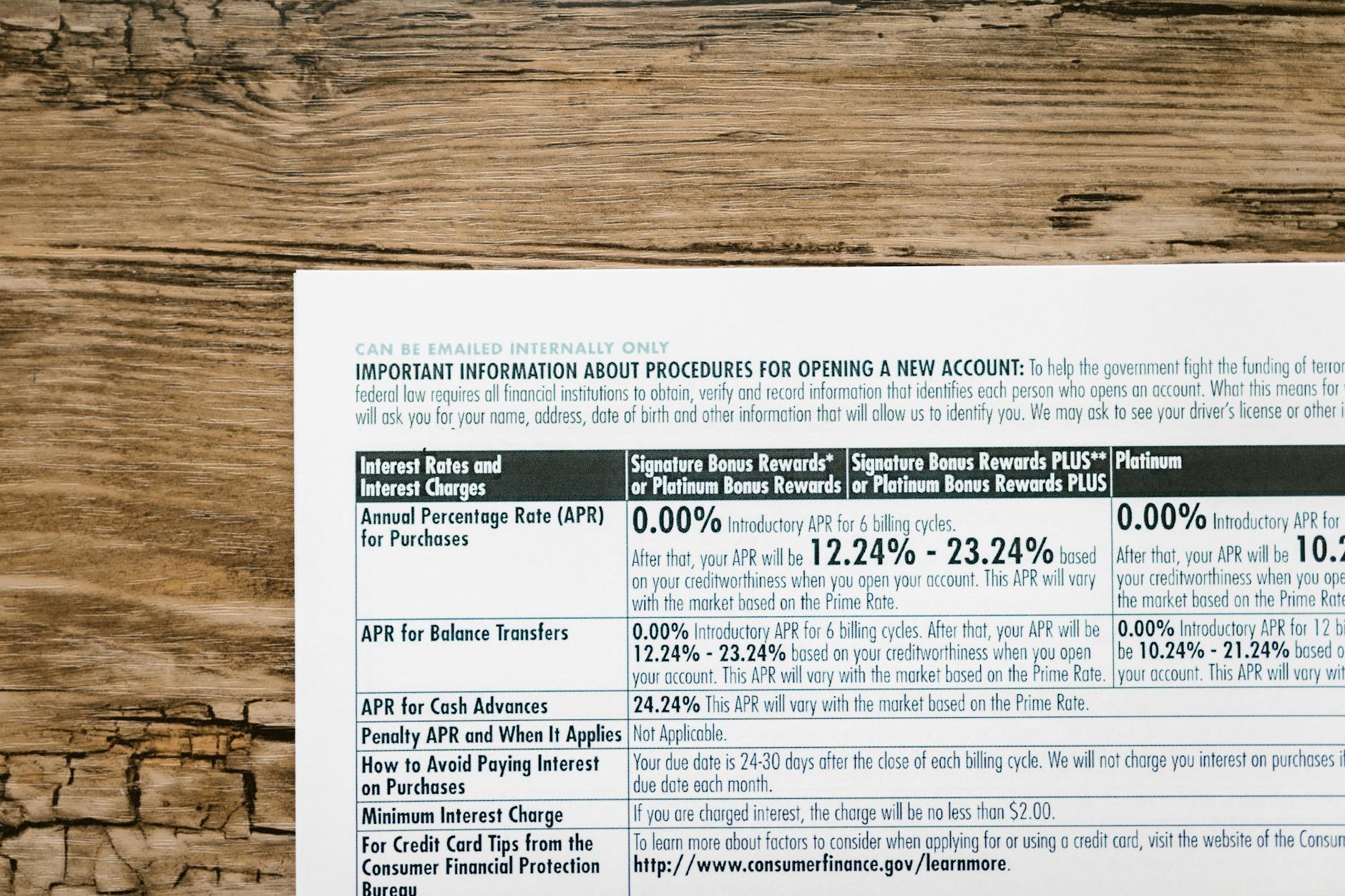

Second, look into accounts with competitive bank accounts interest rates. Higher interest rates mean your money works harder for you, making every creative gig a step toward a more secure financial future. Also, explore low-fee options to avoid unexpected costs—every dollar saved is a dollar earned!

Lastly, prioritize accounts offering flexible features like mobile banking tools. These can help seamlessly manage income from your latest design project while you sip coffee and sketch in a vibrant Melbourne café. Understanding these options empowers you to tackle financial matters with as much flair and innovation as your next artistic endeavor.

Managing Freelance Income

Balancing creativity with financial savvy can be quite a journey, especially in the bustling artistic hub of Melbourne's Fitzroy. For a graphic designer like Jacob, setting up a reliable savings buffer is crucial to manage the ebb and flow of freelance income. One smart strategy is to create a separate account specifically for savings, allowing you to keep track of your funds without mixing personal expenses—elevating your financial stability one step at a time. Knowing how to set up a joint bank accounts can also be invaluable as you begin to plan for a future with your partner.

Freelancers might consider high interest savings accounts rates to make their money work harder. While standard savings accounts may provide minimal returns, high-interest options can accumulate more over time, making them a strategic choice for young creatives looking to maximize their earnings.

Internet banking tools can streamline financial management, offering features that simplify income tracking, expense categorization, and budget planning. Using digital platforms not only enhances convenience but also provides comprehensive insights into your financial health. For those asking, "How how do i get a bank accounts that suits my freelance lifestyle?" the key lies in researching options that align with your financial goals and artistic ambitions.

Taking control of your freelance income may seem challenging, but with the right strategies, you can confidently turn your creative passions into a sustainable livelihood.

Exploring Joint Accounts

Steps to Open a Joint Account

Opening a joint account can feel as inspiring as stepping into a Melbourne CBD art gallery. It begins with a conversation between you and your partner, ensuring you're on the same page financially and creatively. Once you've talked it out, the next step is to gather necessary documents like identification and proof of address for both parties. This process is akin to preparing a design brief—organised, thoughtful, and clear.

To open a joint account, reach out to your bank or visit its website to explore how to open up another bank accounts. Many banks offer online application processes, similar to a seamless freelance project submission. When filling out your application, be sure to agree on account types and features that suit both your needs, whether it's a basic chequing account for day-to-day expenses or one that attracts good interest savings rates to boost your finances.

Managing Shared Finances

Managing shared finances requires transparency and understanding, much like crafting a design together. Prepare a budget that aligns with your goals and track expenses to maintain balance. Use innovative tools, like shared apps, to keep everything in check and ensure continual communication—just as vital in financial partnerships as in creative collaborations.

Building Trust with Transparency

Building trust in a financial partnership is about maintaining openness in your financial discussions and decisions. Establish regular check-ins to review your financial standing and adjust your strategies as needed. Consider this financial journey much like an artistic collaboration in Fitzroy's design hubs—open dialogue and honest feedback lead to successful outcomes.

Maximizing Savings Potential

Diving into the world of creative freelancing in Melbourne, financial empowerment is a key component for ensuring long-term stability. Finding high-interest accounts can be your first step towards financial independence. By exploring various options available, you can identify which savings accounts align best with your income cycles and investment goals. Remember, the right account isn't just about the interest rate; it's about understanding what is savings accounts, the fees, and any additional benefits that may be offered.

Automating your savings transfers is another fantastic strategy. This not only ensures that a portion of your income is always directed towards savings but also fosters a disciplined approach to managing your finances. Setting up recurring transfers can help maintain consistency and can be easily arranged through online banking, which fits seamlessly into a busy life spent between design projects and creative collaborations.

Additionally, compare the terms and conditions of different accounts. Look beyond the promotional rates to understand the true value an account brings over time. Each account may offer unique features, providing opportunities for savings growth. Whether you're contemplating what is a joint bank accounts for shared financial endeavors or focused on individual goals, having a clear view of potential fees and requirements is crucial.

Avoiding Financial Pitfalls

Navigating Hidden Fees

In the vibrant creative scenes of Melbourne, from our striking CBD art galleries to the eclectic studios of Fitzroy, it's paramount to keep an eye on hidden fees, often masked within your bank account. As a freelance designer, each dollar counts, giving you the freedom to peruse design hubs or sip coffee at Abbotsford Convent's courtyard with ease. When choosing a bank, be vigilant about account maintenance costs. Look for options with minimal charges to support your financial stability, ensuring your funds are directed towards investments in your craft rather than unnecessary expenditures.

Frequent Account Reviews

Adapt like an artist capturing the dynamic movements of the Yarra River. Regularly reviewing your account details is crucial. The freelance world demands agility, and by consistently assessing your financial standing, you can swiftly adjust strategies, maximising benefits from commonwealth bank youth account options or discovering the best features of a current bank account offer. In a space as innovative as Melbourne, where new opportunities arise daily, staying informed keeps you ahead of the curve.

Setting Realistic Savings Targets

Setting realistic savings goals can be likened to planning an intricate mural. It's about envisioning the end, budgeting your colours and resources precisely. Avoid miscalculations by creating a solid financial roadmap. Determine how much of your freelance income you can afford to allocate while still allowing spontaneous art supplies splurges or gallery visits. Embrace financial tools that aid this journey, ensuring you're prepared to support design dreams while securing your future creativity canvas.